Arbitrum Surges Ahead as Ethereum’s Layer 2 Landscape Takes Shape

Layer 2 rollups now see more transaction volume than Ethereum’s main network.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ZLVWZ6MQNRD6FE6B2PAI47NW7A.jpeg)

(DALL-E/CoinDesk)

Ethereum’s layer 2 landscape is finally taking form, and Arbitrum is in the lead.

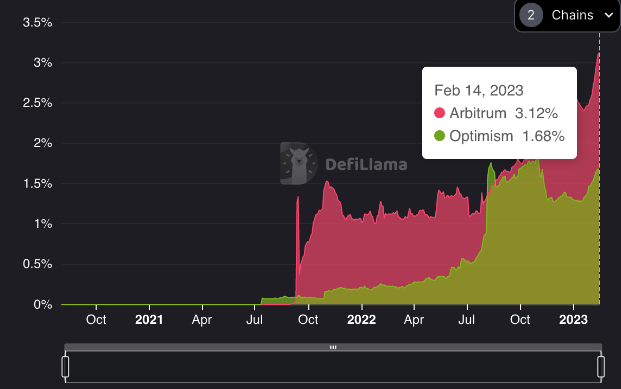

Arbitrum is currently the fourth-largest blockchain in terms of the total value locked (TVL) into its decentralized finance (DeFi) ecosystem, according to DefiLlama.

Its $1.49 billion TVL is nearly double that of its main competitor, Optimism, which uses similar technology to scale Ethereum yet has a TVL closer to $800 million.

This article originally appeared in Valid Points, CoinDesk’s weekly newsletter breaking down Ethereum’s evolution and its impact on crypto markets. Subscribe to get it in your inbox every Wednesday.

TVL of Arbitrum and Optimism (DeFiLlama)

Arbitrum owes much of its recent growth to GMX, a decentralized spot and perpetual exchange that launched in September 2021 and has since grown precipitously. GMX currently accounts for about 30% of Arbitrum’s entire TVL, about $457 million. (GMX is also deployed on the Avalanche blockchain, though its footprint there is around a quarter the size).

Decentralized finance platforms like GMX use smart contracts to allow users to transact without intermediaries, and they collect fees from users as a way to reward liquidity providers and community members. GMX has been so successful in recent months that, during a 24-hour period this past weekend, it earned more in transaction fees than the Ethereum blockchain did during the same period.

Ethereum’s layer 2 landscape

When Ethereum transaction fees skyrocketed last year in response to increased user demand, rollups – separate blockchains that bundle up and “settle” transactions on Ethereum – were viewed as an urgently needed solution to the chain’s growing accessibility problem. Unlike sidechains like Polygon PoS, which also bundle up transactions and settle them on Ethereum, rollups (also called layer 2 platforms) take advantage of Ethereum’s existing security apparatus.

The first big rollup chains to market were Optimism and Arbitrum, both classified as “Optimistic” rollups in reference to the mechanism they use to borrow Ethereum’s security.

Transaction fees on Optimism and Arbitrum currently average around 20 cents and 14 cents, respectively, according to data from Blockworks. In comparison, average transaction fees on Ethereum are over 75 cents, according to yCharts.

Ethereum’s layer 2 ecosystem had a slow start, and the total value locked across layer 2 rollups continues to be an order of magnitude lower than that locked on Ethereum. However, in recent months, layer 2 projects have consistently seen higher combined transaction volumes than Ethereum’s base chain, according to L2beat.

Arbitrum employed a different growth strategy from Optimism, which, in a bid to attract more users, offered its native OP as an incentive for people to use some Optimism-based apps.

Arbitrum does not have a token, meaning it relied on the organic growth of its decentralized finance ecosystem to attract users to its platform. It is possible, though, that Arbitrum’s usage numbers have been inflated somewhat by bots designed to farm the platform’s yet-to-be-announced token. (When crypto protocols announce tokens, they frequently airdrop some of them as a reward to existing users.)

Arbitrum and Optimism remain the largest rollups today, but they will face stiff competition in the coming months from a new cohort of upcoming zkEVMs – a more advanced breed of rollups that uses zero-knowledge cryptography to improve fees and security.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Qc1SOsxolC6_Esqs89-xeXCpbKk=/arc-photo-coindesk/arc2-prod/public/VDZCFPNTYVCTNBFQBVIGFLKBAA.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HHAZAAXSBJD3NLASNFQDKP3WOE.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/3XAH3BH7BZE5ZNY2XTZ5BLD7QI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/MM3UAOZCG5AUZIPOQ65VFTGA4U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Z3I2HMMBABCOJMIVKQT34UWXHI.jpg)