The U.S. Securities and Exchange Commission sued Terraform Labs and Do Kwon last week, alleging the terraUSD stablecoin was a security, alongside various other tokens and products. This feels pretty important.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Stablecoins as Securities (Again)

The narrative

Yeah, I had this exact same subheading last week. But look, some things have changed. Specifically, the U.S. Securities and Exchange Commission (SEC) has now sued Terraform Labs and co-founder/former CEO Do Kwon on allegations of fraud, selling unregistered securities and other related claims.

Why it matters

Last week I wrote about the SEC potentially calling a stablecoin a security. The SEC hasn’t actually alleged so in a court filing yet – it’s only said it thinks Binance USD is a security in a Wells Notice to Paxos. In suing Terraform, the SEC is actually alleging that terraUSD (UST) is a security, alongside basically every other token issued by Terraform Labs.

Breaking it down

The SEC sparked outrage within the crypto community in September 2021 by subpoenaing an at-the-time unnamed individual while at Messari’s Mainnet conference. Though he initially denied receiving the subpoena, Do Kwon later admitted he had been the one to receive the subpoena when he sued the SEC over allegations of violating the Administrative Procedures Act and due process (the case was voluntarily dismissed last year). The SEC’s interest appeared to be in the Mirror Protocol (which had MIR tokens on top of it), which helped create mirrored assets (mAssets), basically tokens pegged to the price of stocks.

Mirror had a rough few months in there, facing multiple multimillion-dollar exploits through 2022.

The SEC’s investigation appeared to, well, die down for a while. And of course, Terraform itself had a pretty lousy 2022.

Last Thursday, the SEC sued Terraform and Kwon, whose current whereabouts are a mystery.

According to the filing, the SEC is alleging the defendants sold unregistered “crypto asset securities” and securities-based swaps (the aforementioned mAssets). There's also quite a bit of fraud alleged. The biggest issue may be the claim that UST’s price was not at all stabilized by the LUNA mechanism; rather, the price was artificially maintained by means of an undisclosed firm (apparently Jump Trading) buying a large amount of UST in exchange for discounted LUNA.

Another really interesting aspect of the filing is how thorough the SEC was in explaining its reasoning. The SEC alleged that LUNA, wrapped LUNA, UST, MIR and mAssets were all securities, providing a detailed Howey analysis for the first four types of tokens and explaining how the last one was a securities-based swap.

It wasn’t just Howey, though – as attorneys Collins Belton and Gabriel Shapiro both pointed out, the SEC also used other analyses to allege that things like wrapped LUNA are a security, potentially bolstering its case in case this sets precedent.

So we have the SEC alleging that a (specific) stablecoin is a security, that an ecosystem token tied to the stablecoin is a security, that these other tokens are also securities and doing so with defendants that the industry will be hard-pressed to defend (you know, cause of all the alleged fraud and the whole collapse last year).

If the SEC wins this suit, it’ll have a court ruling affirming its oversight over a certain type of stablecoin and related ecosystem tokens. And while it’s true that generally rulings aren’t necessarily seen as a legal precedent unless at least an appeals court affirm them, we’re seeing district court rulings cited as precedent in all sorts of crypto-related cases right now.

My colleague Jesse Hamilton analyzed the SEC’s recent actions, writing that the SEC’s “shadow rules” are increasingly coming into view with the various lawsuits and settlements. This Terraform Labs suit feels like a very strong contender for having a lasting impact.

Stories you may have missed

- CoinDesk Wins a Polk Award, One of Journalism's Top Prizes, for Explosive FTX Coverage: I think this headline speaks for itself. I could not be more proud to work with reporters such as Ian and Tracy.

- BUSD Drama Sets Stage for Stablecoin Market Reshuffle: The U.S. Securities and Exchange Commission’s possible finding that Binance USD (BUSD) is a security is opening up a possible reshuffling in stablecoin winners.

- Mt. Gox’s 2 Largest Creditors Pick Payout Option That Won’t Force Bitcoin Sell-Off: Sources: Mt. Gox’s two largest creditors have opted for a payout option that will see them receive around 21% of their locked up funds by this September, and receive around 90% of that option in bitcoin.

- Canada Close to Tightening Rules for Crypto Exchanges: Sources: Canada is ready to tighten its cryptocurrency regulations, with the provincial regulators’ umbrella body planning “pre-registration undertaking” updates that would strengthen the requirements companies have to abide by, CoinDesk reported last week. On Wednesday, the Canadian Securities Administrators revealed new custody requirements and strict rules for things like stablecoin listing.

- Bankman-Fried Remains Out on Bond, but Judge Warns ‘Revocation’ Proceedings Possible in Future: The federal judge overseeing FTX founder Sam Bankman-Fried’s criminal case “told the court he had ‘probable cause to believe’ that Bankman-Fried may have committed ‘witness tampering,’ which is a felony, and expressed doubt that he was, in fact, using a VPN to watch football.”

Mr. Washington Goes to Brussels

Over in Brussels, the crypto scene is abuzz with the visit of a delegation from the U.S. Congress hoping to learn the nuts and bolts of crypto regulation.

The trip makes a lot of sense – and not just because lawmakers’ recess dates from both Washington, D.C., and Brussels happened to align this week.

The European Union is right now putting the finishing touches to its Markets in Crypto Assets (MiCA) and transfer of funds regulations, which set out disclosure rules for crypto issuers, reserve requirements for stablecoins, and customer identification rules to tackle money laundering.

Senior Brussels officials are pretty proud of being the first major jurisdiction to regulate the sector, but they worry there’s no point unless other places follow suit. U.S. lawmakers, meanwhile, may feel they can learn something from Europe’s experience on thorny issues like how to regulate coins that don’t have a single centralized issuer, or crypto assets whose characteristics or purpose change over time.

The U.S. delegation appears to be a who’s who of D.C.-based crypto policy experts. A roster seen by CoinDesk includes over a dozen bipartisan staffers for banking and agriculture committees in both Senate and House, plus staffers for lawmakers including Senators Cynthia Lummis (R-Wyo.), Ron Wyden (D-Ore.) and Kyrsten Sinema (I-Ariz.) – all implicated in recent high-profile legislation for the sector.

Sources briefed on the visit told CoinDesk they’re meeting Brussels-based officials from the European Commission and European Parliament, as well as industry body Blockchain for Europe. That’ll be followed by a side trip to nearby Paris, where they’ll talk to officials from the EBA and ESMA, the European Union agencies for banking and securities markets who now need to set out some of MiCA’s finer details.

An EU official, who asked not to be named to speak candidly, told CoinDesk they “hope to inform our counterparts in [the] U.S. Congress about how the EU operates, what motivated us to propose MiCA, and what the substantive requirements and policy choices that were made in the MiCA negotiations are,” calling for greater coordination of an international ecosystem.

Industry representatives, too, hope Washington will at least partly copy Brussels’ example, and put in place a sensible and discerning crypto framework, rather than relying on occasional and sometimes unpredictable enforcement crackdowns like the Securities and Exchange Commission’s recent move against Kraken.

“I hope they are taking notes,” Ava Labs’ General Counsel Lee Schneider told CoinDesk. “I wish there was more regulation, instead of enforcement actions.”

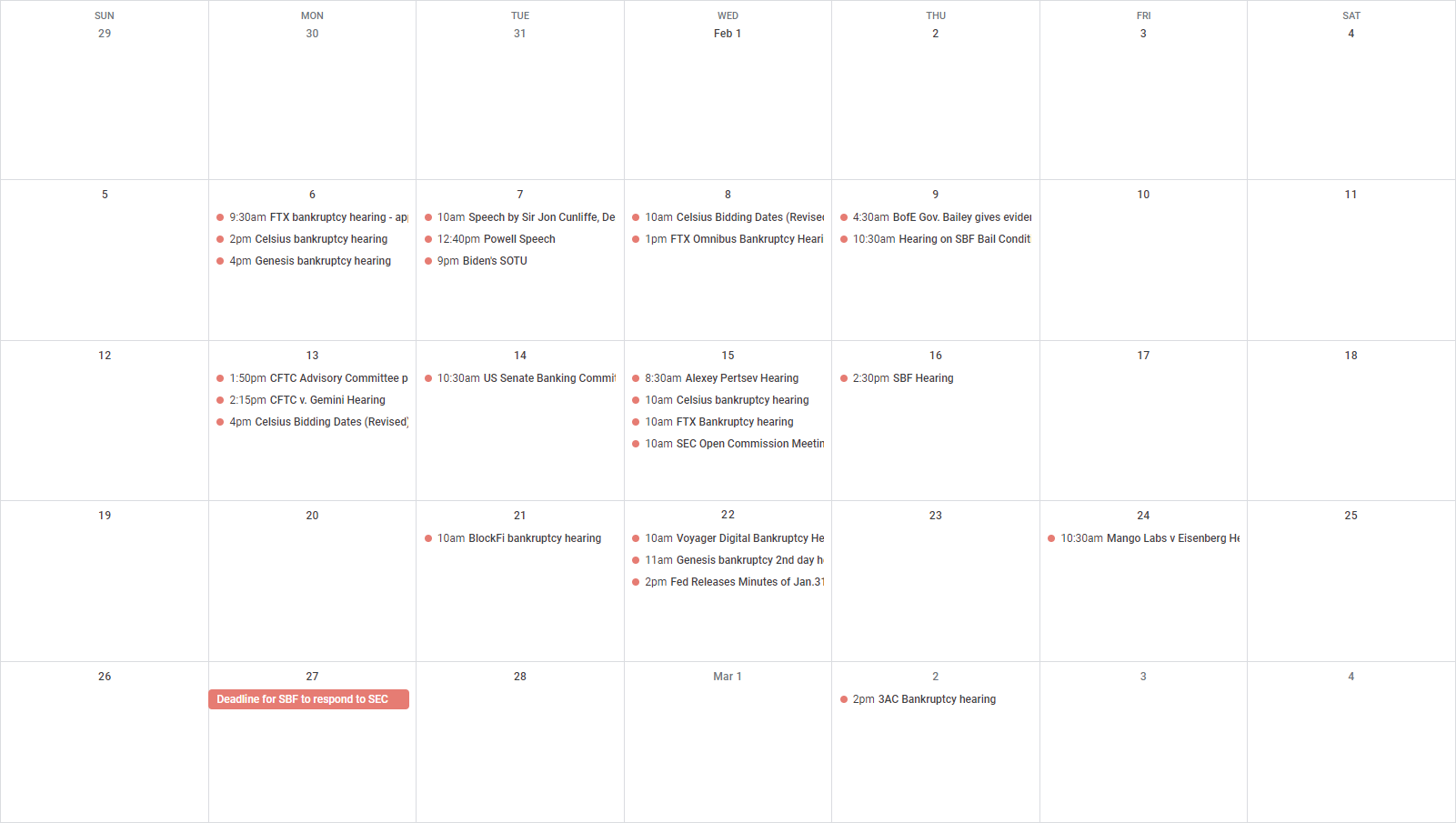

This Week

Tuesday

- 15:00 UTC (10:00 a.m. ET): BlockFi bankruptcy hearing

Wednesday

- 15:00 UTC (10:00 a.m. ET) Voyager bankruptcy hearing

- 16:00 UTC (11:00 a.m. ET) Genesis bankruptcy hearing

- 19:00 UTC (2:00 p.m. ET) Fed minutes

Friday

- 15:30 UTC (10:30 a.m. ET) Mango Labs v. Avraham Eisenberg hearing

Elsewhere:

- (Reuters) Binance, the global cryptocurrency exchange, had access to Binance.US’ Silvergate bank account in late 2020 and early 2021 and moved funds from Silvergate to a trading firm managed by Binance CEO Changpeng Zhao which is currently under investigation by the U.S. Securities and Exchange Commission, Reuters reported last week. Binance.US tweeted a response which did not appear to address any of the actual claims in the report.

- (Politico) I’m a sucker for public records requests. Politico filed Freedom of Information Act requests for information about student borrowers who sought relief for federal loans last fall.

- (Popular Mechanics) This is a well-reported article on the noise pollution apparently caused by a crypto mine in North Carolina bothering the residents of a nearby town – including the local wildlife. The article also touches on the implied threats one of the mine’s opponents received.

- (The Wall Street Journal) The Wall Street Journal took a look at one crypto industry issue that’s long lacked (some) clarity: how auditors should look at firms wanting to publish attestations or other assurances.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See ya’ll next week!

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/www.coindesk.com/resizer/BETd9o0r2OHtd2vT2ZqY9QPrJps=/arc-photo-coindesk/arc2-prod/public/ODFQHDRZFJG7XNVO7P6PUYMWS4.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HHAZAAXSBJD3NLASNFQDKP3WOE.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/3XAH3BH7BZE5ZNY2XTZ5BLD7QI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/MM3UAOZCG5AUZIPOQ65VFTGA4U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Z3I2HMMBABCOJMIVKQT34UWXHI.jpg)