Federal prosecutors have shared more information about their case against FTX founder Sam Bankman-Fried. Between two new indictments and civil suits against another former FTX executive, we now have a much clearer picture about what the Department of Justice thinks it has.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Misappropriation

The narrative

Last week, federal prosecutors added four charges to FTX founder Sam Bankman-Fried’s criminal case, announcing in a superseding indictment that in addition to the existing fraud and campaign finance violation allegations, they would tack on charges of bank fraud and operating an unlicensed money transmitter, and provide far more detail about the other charges.

Providing further detail about the case against Bankman-Fried were this week’s charges against Nishad Singh, the former director of engineering at FTX. Singh pleaded guilty to criminal charges on Tuesday, but also faces civil charges from the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

Why it matters

Bankman-Fried goes to trial in seven months. Lawyers for both prosecutors and his defense team are still working through discovery, but the newest indictments and lawsuits filed against him and Singh shed a lot more light on the case against Bankman-Fried than his original indictment in January did.

Breaking it down

Last Thursday, prosecutors revealed a superseding indictment against FTX founder Sam Bankman-Fried. The new document provided far more details about the allegations against the 30-year-old, including providing more specific charges and tacking on a few additional ones.

Within the pages of the indictment are allegations that Bankman-Fried launched or directed the launch of various companies that could secure bank accounts, as FTX couldn’t on its own. The DOJ says Bankman-Fried oversaw the misappropriation of customer funds and explicitly directed his team to obfuscate the source of funds donated to political campaigns.

Under the superseding indictment, Bankman-Fried faces charges of:

- Conspiracy to commit wire fraud on FTX customers

- Wire fraud on FTX customers

- Conspiracy to commit fraud on FTX customers tied to derivatives

- Fraud on FTX customers tied to derivatives

- Conspiracy to commit securities fraud on FTX customers

- Securities fraud on FTX customers

- Conspiracy to commit wire fraud on Alameda Research lenders

- Wire fraud on Alameda Research lenders

- Conspiracy to commit bank fraud

- Conspiracy to operate an unlicensed money transmitting business

- Conspiracy to commit money laundering

- Conspiracy to make unlawful political contributions and defraud the FEC

The original indictment merely listed charges of:

- Conspiracy to commit wire fraud on customers

- Wire fraud on customers

- Conspiracy to commit wire fraud on lenders

- Wire fraud on lenders

- Conspiracy to commit commodities fraud

- Conspiracy to commit securities fraud

- Conspiracy to commit money laundering

- Conspiracy to defraud the U.S. and violate campaign finance laws

Beyond that, the new documents provide a lot of little details that contain rather serious allegations.

“In November 2022, the general counsel of FTX.US warned employees that they should preserve documents because of the involvement of regulators, and then posted in a company Slack channel that FTX would need to be shut down,” one section of the superseding indictment said. “Bankman-Fried, however, deleted the general counsel's message about FTX being shut down, continued to use Signal messaging and proceeded to delete some of his own statements on Twitter, including his tweets about customer assets being ‘fine.’”

The FTX founder also allegedly directed the creation of North Dimension, a U.S.-based company, purely to act as an intermediary between FTX and U.S. banks. Prosecutors claim Bankman-Fried lied about North Dimension’s true purpose to get through a bank’s due diligence process.

Moreover, prosecutors hold that Bankman-Fried never segregated FTX customer assets from Alameda assets or other assets, despite “representations … to the contrary.”

Bankman-Fried “used the FTX customer funds he misappropriated and caused to be misappropriated to, among other things … finance in substantial part [his] unlawful political influence campaign, which involved flooding the political system with tens of millions of dollars in illegal contributions to both Democrats and Republicans made in the names of others in order to obscure the true source of the money and evade federal election law,” the indictment said.

The document alleged that Bankman-Fried, while openly willing to support Democrats, also bolstered Republicans by having an unidentified co-conspirator be the public face of those donations.

While the document does not name the individual, CoinDesk reporting found that dozens of Republicans received donations from FTX Digital Markets co-CEO Ryan Salame. Salame has not been accused of any wrongdoing as of press time.

Another unidentified co-conspirator appears to be Nishad Singh, the former engineering director. While the criminal indictment against Singh does not mention Bankman-Fried by name, prosecutors filed the “conspiracy to make unlawful political contributions” charge against him that they filed against the former CEO.

The indictment details how Singh allegedly donated to candidates and committees well in excess of federal limits and lied about their origin.

“In or about 2022, Nishad Singh, the defendant, and one or more other conspirators agreed to and did make contributions to candidates and committees in the Southern District of New York that were paid for using funds from Alameda Research and reported to the Federal Election Commission in the names of persons other than the true source of the funds,” the filing said.

The SEC and CFTC filings against Singh are both more willing to mention Bankman-Fried (as well as other former FTX executives).

The SEC filing spends a lot of time looking at the way FTX and Alameda were structured, noting Alameda’s ability to have a negative balance on FTX’s books and the alleged misappropriation of customer funds to other uses. Similarly, the CFTC filing claims federal violations based on how the companies were set up and what they actually did.

Stories you may have missed

- Unrelated BASE Token Jumped 250% After Coinbase Starts Layer 2 Network Base: Never change, crypto, never change.

- Crypto Wallet Firm Dfns Says ‘Magic Links’ Have Critical Vulnerability: There's responsible vulnerability disclosure and then there's whatever the heck you’d call three days’ notice.

- Robinhood Received Crypto-Related Subpoena Request From SEC: 10K: The U.S. Securities and Exchange Commission and the California Attorney General sent subpoenas to Robinhood over its crypto offerings, the company said in its most recent filing, but did not provide a lot of detail about these subpoenas.

- Solana Network Stumbles, On-Chain Trading Slows After ‘Forking’ Incident: Solana appears to have frozen (again) over the weekend.

- Oasis Exploits Its Own Wallet Software to Seize Crypto Stolen in Wormhole Hack: Immutable! Or in the words of Matt Levine, customer service pursuant to a court order.

The eNaira’s travails

The world is watching Nigeria’s eNaira approach as the country transitions to a new president following heated elections.

Countries around the globe are debating whether to issue a central bank digital currency (CBDC) within 10 years, and will be absorbing lessons from Nigeria’s live eNaira.

“A lot of people have been watching Nigeria as an experiment,” said Varun Paul, CBDC and market infrastructure director at Fireblocks. Paul was previously the head of the Bank of England's fintech hub.

Countries will likely be looking to see if Nigeria cracks the code on CBDC adoption.

The country launched its eNaira in October 2021, after researching for around two years, and it faced low adoption. A year after it launched, less than 0.5% of Nigerians were using the eNaira, Bloomberg reported.

The Central Bank of Nigeria even limited the amount of cash people can withdraw from banks in January to encourage the adoption of the eNaira but despite its efforts people are not looking to the eNaira as an alternative – even in the midst of a cash crisis.

People are currently complaining on Twitter that they are not able to access basic needs like fuel or food without cash (thanks in part to Nigeria's $220 billion informal economy that relies on cash and a limited amount of bank notes in circulation).

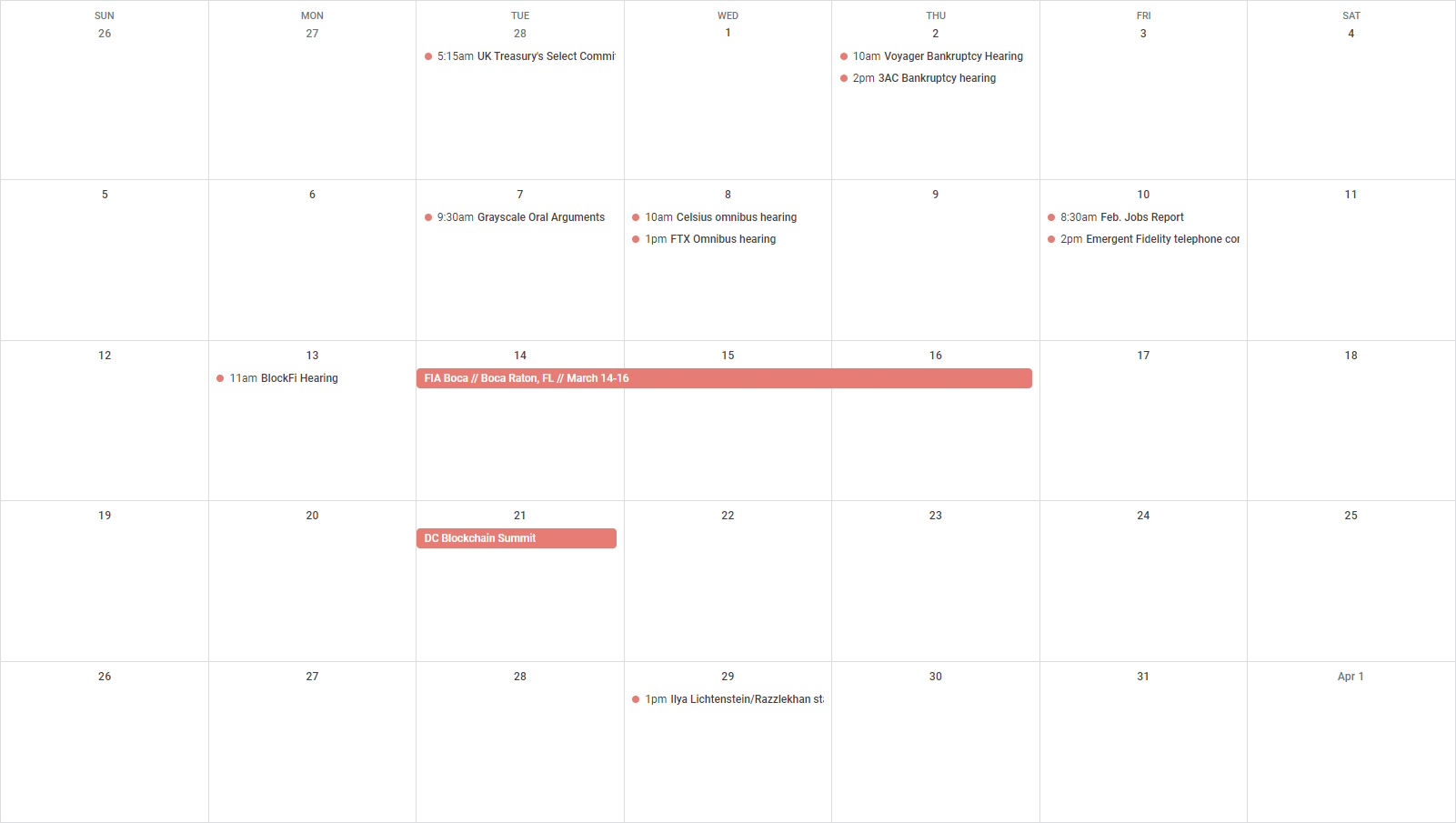

This week

Tuesday

- 10:15 UTC (5:15 a.m. ET) The U.K. Treasury’s Select Committee discussed crypto assets, with Prudential Policy Executive Director Victoria Saporta announcing the U.K. plans to propose rules on the issuance and holding of digital assets.

Thursday

- 15:00 UTC (10:00 a.m. ET) Voyager Digital goes back to court to seek approval of its Chapter 11 restructuring plan, which includes potentially selling assets to Binance.US – a plan that’s received overwhelming support from Voyager’s customers, despite regulators’ hesitance.

- 19:00 UTC (2:00 p.m. ET) Three Arrows Capital will also be going back to court to discuss subpoenas.

Elsewhere:

- (Vice) Cybersecurity reporter Joseph Cox was able to bypass his bank’s biometric voice-based security system using AI tools.

- (Platformer) The U.S. Supreme Court is hearing a case with implications on Section 230 of the Communications and Decency Act, otherwise known as the law that explicitly allows platforms to remain free of liability for what their users post. And, weirdly enough, the lawyers fighting to weaken 230 seem a little underprepared.

- (Molly White) Molly White has a more in-depth explanation of what happened with Oasis and its effort to recover stolen crypto by way of exploiting its own network.

- (Ars Technica) Password service LastPass is finally providing details about how its systems were compromised last year.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See ya’ll next week!

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NCUUDKLO25BMXIBXQ7CVYRCGBE.jpg)

:format(jpg)/www.coindesk.com/resizer/BETd9o0r2OHtd2vT2ZqY9QPrJps=/arc-photo-coindesk/arc2-prod/public/ODFQHDRZFJG7XNVO7P6PUYMWS4.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HHAZAAXSBJD3NLASNFQDKP3WOE.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/3XAH3BH7BZE5ZNY2XTZ5BLD7QI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/MM3UAOZCG5AUZIPOQ65VFTGA4U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Z3I2HMMBABCOJMIVKQT34UWXHI.jpg)