First Mover Americas: First Citizens Scoops Up Big Chunks of Silicon Valley Bank

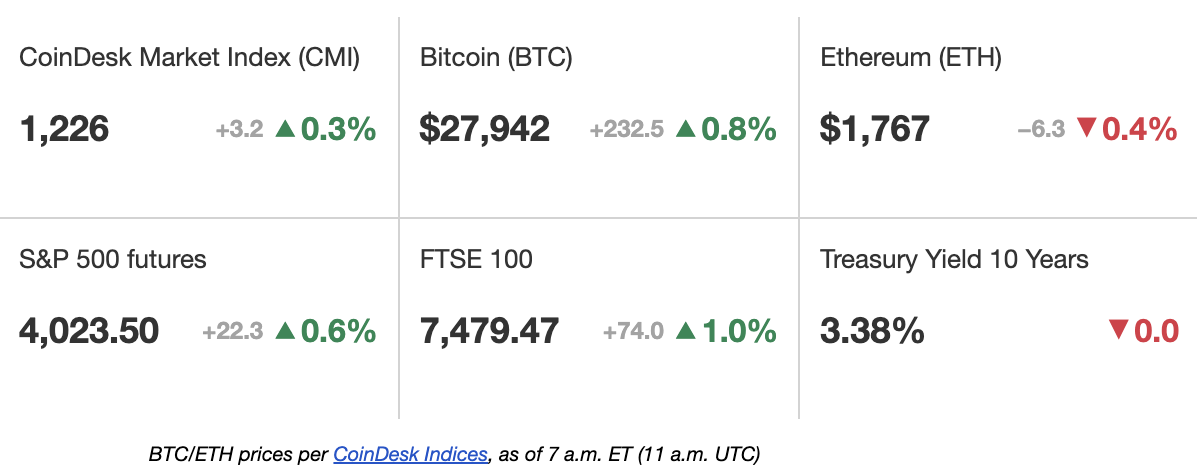

The latest price moves in crypto markets in context for March 27, 2023.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/XOX6TWKGLFDEXMDQ6DPS4N5CRA)

Much of Silicon Valley Bank is being acquired by First Citizens Bank. (CoinDesk archives)

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

The Federal Deposit Insurance Corp. announced late Sunday that First Citizens Bank will acquire the deposits, loans and branches of failed Silicon Valley Bank, an institution that catered to tech startups, including crypto firms. Bloomberg had initially reported that a deal was nearing completion and could be announced as early as Monday morning. In a statement, the FDIC said that all depositors of Silicon Valley Bridge Bank, the bridge bank set up by the FDIC after the collapse of Silicon Valley Bank, will automatically become depositors of First-Citizens Bank & Trust Co. (FCNCO). All deposits assumed by First Citizens Bank, a regional bank based in Raleigh, N.C., will continue to be insured by the FDIC up to the insurance limit. As of March 10, Silicon Valley Bridge Bank reported roughly $167 billion in assets and nearly $119 billion in deposits.

The crypto market managed to hold its ground over the weekend, with bitcoin up 1% over the past 24 hours to about $27,900. The cryptocurrency stayed in a range of between $27,000 and $28,000 throughout the weekend after reaching almost $30,000 early last week. Simon Peters, an analyst at trading platform eToro, said in a note Monday that a short-term pullback is possible. Ether was down slightly in the past 24 hours to about $1,700. European stocks opened higher on Monday as investors hope for an end to banking volatility. U.S. equity futures also edged higher.

Cathy Wood's Ark Invest bought $12.6 million of Coinbase (COIN) shares on Friday, the second straight day the investment firm purchased the crypto exchange's stock after the company received a Wells Notice from the U.S. Securities and Exchange Commission on March 22, sending the shares tumbling 16% the next day. The stock gained 1.5% on Friday to $67.83. According to an email sent Friday night, 155,833 shares went to ARK Innovation EFT (ARKK), and 26,395 shares went to ARK Next Generation Internet EFT (ARKW). The Wells Notice was a warning from the SEC that it believes Coinbase violated investor-protection laws and could be a signal that the SEC will sue the company.

Trending Posts

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HHAZAAXSBJD3NLASNFQDKP3WOE.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/3XAH3BH7BZE5ZNY2XTZ5BLD7QI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/MM3UAOZCG5AUZIPOQ65VFTGA4U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Z3I2HMMBABCOJMIVKQT34UWXHI.jpg)