First Mover Americas: Dogecoin Pops on New Twitter Logo

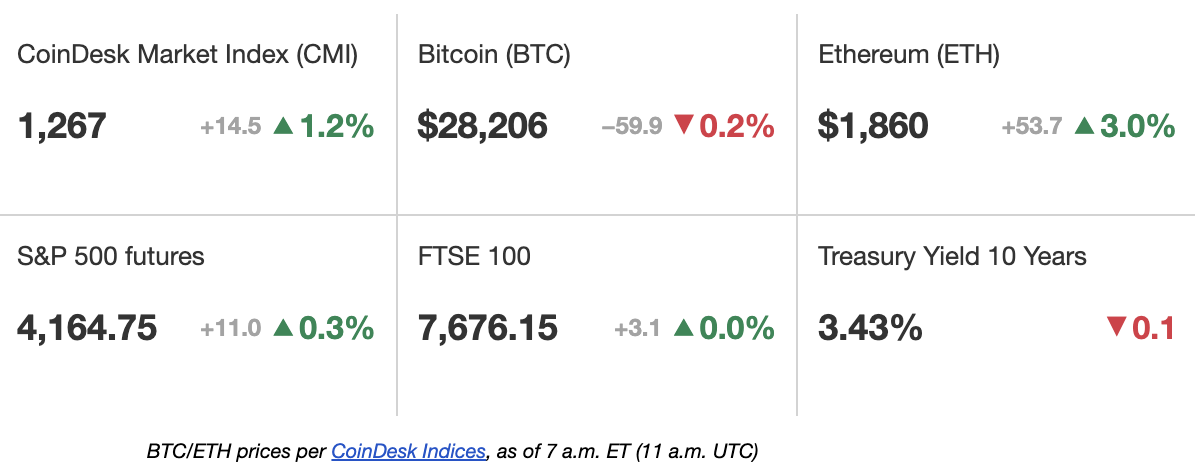

The latest price moves in crypto markets in context for April 4, 2023.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/J3ICBS5WZJFSJB3O3OASKPZVEQ.png)

Dogecoin is surging after Twitter changed its logo to the Shiba Inu image that's a symbol of DOGE. (Twitter)

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Dogecoin (DOGE) surged more than 35% after Elon Musk's Twitter replaced the social-media platform's familiar blue bird atop its homepage with the cryptocurrency's iconic Shiba Inu dog logo. DOGE was trading at around 10 cents on Tuesday. Before Monday, its price last exceeded 10 cents in December, according to CoinDesk data. Musk has frequently touted DOGE, suggesting the meme coin may offer better payments functionality than bitcoin. Following the logo change, Musk tweeted out a cartoon image as his first public comment.

Binance, the world’s largest crypto exchange, has seen a sizable drop in market share after a U.S. regulator accused it of fraud and the exchange eliminated zero-fee trading for some trading pairs. Its market share of trading volume has sunk to 54% from 70% two weeks ago, according to data from research platform Kaiko. That’s the lowest level since Nov. 5 and the lowest sustained market share since August, Kaiko said. In the U.S., crypto exchange Coinbase's (COIN) market share fell to a weekly average of 49% from 60% during the first quarter, while Binance.US picked up the slack. Its market share rose to 24% from 8% during the quarter, Kaiko said.

Voyager Digital and its creditors stand to lose $100 million if legal objections brought by the U.S. government aren't resolved by April 13, according to legal documents filed late Monday night. The bankrupt crypto lender is taking urgent legal action to let a $1 billion purchase by Binance.US go ahead, fearful that quibbles over the contractual drafting could see the exchange pull out. “Consummation of the plan by April 13 is necessary to preserve massive creditor value,” a filing by Voyager’s creditors stated. “The evidence is uncontroverted that, if the deal is not completed, Voyager’s creditors will lose roughly $100 million in value.”

Chart of the Day

- The chart shows dogecoin has rallied to a four-month high, breaking out of a "Bollinger Bands squeeze."

- Bollinger Bands are volatility indicators placed two standard deviations above and below the price’s 20-day moving average.

- A squeeze occurs when price volatility drops and Bollinger Bands tighten. A subsequent breakout represents a volatility explosion, paving the way for an extended rally, as seen in late October.

Trending Posts

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HHAZAAXSBJD3NLASNFQDKP3WOE.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/3XAH3BH7BZE5ZNY2XTZ5BLD7QI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/MM3UAOZCG5AUZIPOQ65VFTGA4U.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/Z3I2HMMBABCOJMIVKQT34UWXHI.jpg)