The U.S. Securities and Exchange Commission filed a lawsuit against crypto exchange Beaxy last week, alleging it offered an unregistered securities sale through a 2018 initial coin offering, and that it operated as an unregistered securities exchange, broker-dealer and clearing agency.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Preview

The narrative

The U.S. Securities and Exchange Commission (SEC) filed charges against crypto exchange Beaxy last week, resulting in the exchange shuttering its doors after the regulator alleged it raised $8 million in an unregistered securities offering and that the company’s founder “misappropriated” nearly $1 million for personal use.

Why it matters

Among its allegations, the SEC said Beaxy operated as an unregistered exchange, a broker and a clearing agency. I strongly suspect – and I’m guessing I’m not the only one – that this may be a preview of how the SEC’s case against other crypto exchanges (cough) may go.

Breaking it down

The SEC’s complaint against Beaxy is fascinating to my non-lawyer eye.

Beaxy, for its part, claimed an “uncertain regulatory environment” as the reason for its shutdown ahead of the lawsuit’s publication.

But the SEC suit seems pretty clear. According to the complaint, Beaxy carried out the functions one might expect a national securities exchange, a broker and a clearing agency all would carry out despite not registering as any of these with the regulator.

The SEC took great pains to specify all of these issues in the complaint.

“Platforms like the Beaxy Platform require users to deposit with the platform all of the crypto asset securities that they traded there, resulting in the platform possessing, and even becoming the legal owner of such assets and thus a central securities depository,” the filing said. “This type of arrangement means that an unregistered crypto asset platform like the Beaxy Platform could use assets in their possession and control for its own purposes, thereby exposing investors to significant and at times undisclosed risk of loss of their assets. Investors who invest through such a platform may face a risk that, if the platform were to enter bankruptcy, they might not be able to withdraw their assets and would become unsecured creditors of the bankruptcy estate.”

(This is what happened to most users of the various crypto lenders that filed for bankruptcy last year, including but not limited to BlockFi, Voyager Digital and Celsius Network, as well as fellow crypto exchange FTX.)

The next few paragraphs then contrasted Beaxy with the traditional securities world, noting that a national securities exchange would not “take possession or control” of an asset being traded, while clearing agencies handle settlement and broker-dealers.

“The Beaxy Platform also had the ability to trade crypto asset securities against its own customers, which gives it the means and the motive to put itself on the winning side of each trade, without regard to obligations that apply to registered broker-dealers,” the filing said.

The regulator also filed charges tied to Beaxy’s initial coin offering of BXY tokens in 2018, describing them as tokens that Beaxy and its founder marketed “by promoting its profit potential as tied to the success of the Beaxy platform” (under the precepts of the Howey Test) and its founder’s allegedly fraudulent conduct (misappropriating $900,000 of company funds, around half of which he paid back when giving up control of the company).

The SEC is looking for the usual penalties – disgorgement, fines, etc. – in the lawsuit.

This absolutely reads like a playbook for how the SEC could sue Coinbase, if that situation doesn’t resolve with a settlement or non-action. We don’t know a lot about the Coinbase Wells Notice. So far all Coinbase has said is that the notice lists “an undefined” number of its listed cryptocurrencies, and that its Earn, Prime and Wallet products potentially violate securities law.

It doesn’t look like Beaxy or its executives settled the charges with the SEC, but the fact the exchange is shutting down suggests this will be the kind of case the SEC may look to for a potentially easy win ahead of the Coinbase lawsuit.

While this complaint seems pretty clear, as ConsenSys’ Matt Corva pointed out, part of the issue with registration is figuring out the asset aspect of it all.

Stories you may have missed

- The UK Has Created Crypto Banking Problems: CoinDesk’s Camomile Shumba reported the other week that the U.K.’s banks are becoming increasingly reticent about working with crypto clients, despite Prime Minister Rishi Sunak’s past pledge to make the nation a crypto haven.

- Binance's BNB, Bitcoin Tumble After Crypto Twitter Personality Cobie's Wild Guess: Hm. Yeah. I don’t know that I can really add to this headline about Monday’s CZ Interpol Red Notice scuttlebutt.

- FTX Founder Sam Bankman-Fried Pleads Not Guilty to Latest Bribery Charge: Sam Bankman-Fried was charged with a 13th count last week in his ongoing criminal case, this one alleging he tried to bribe Chinese government officials. He pleaded not guilty.

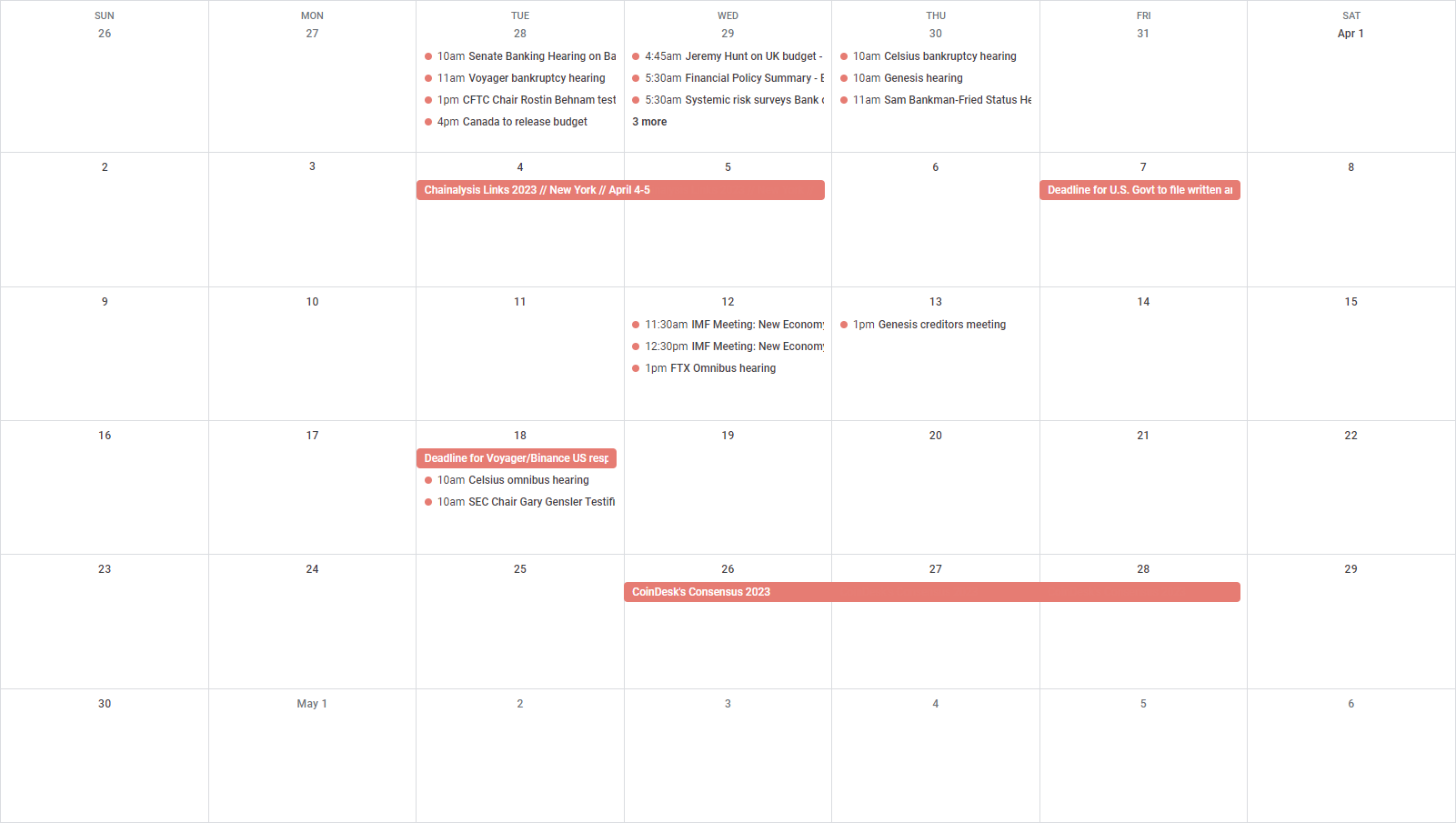

This week

Tuesday/Wednesday:

- 13:00 UTC (9:00 a.m. ET) Chainalysis is holding its annual LINKS conference in New York. A few CoinDesk reporters, including myself, will be around.

Friday:

- The federal judge overseeing the U.S. government’s appeal of the Binance.US acquisition of Voyager Digital set April 7 as the deadline for the government’s written submission.

Elsewhere:

- (The Washington Post): Silicon Valley Bank developed a model that showed “higher interest rates could have a devastating impact on the bank’s future earnings” but executives didn’t like it so they changed it, the Post reports.

- (Vice): A bill that would ban video sharing app TikTok is extremely broad and could affect the legality of virtual private network usage and other tools, Vice reports.

- (New York Times): Police in Jefferson Parish, Louisiana, used facial recognition technology to identify a suspect in a string of robberies. Only it identified the wrong person.

- (Molly White): I tend to agree with Molly White’s assertion here that recent regulator enforcement actions have started clearing up some of the open questions asked by the industry.

- (CNBC): Elon Musk, Tesla and the Dogecoin Foundation filed to dismiss a putative class-action lawsuit alleging they pumped the price of dogecoin, among other things. I haven’t read the suit in full but it alleges that the defendants created a pyramid scheme to pump DOGE, which may have an uphill battle. Also, Twitter’s logo changed to the dogecoin logo on Monday, for whatever reason, causing the price to jump like 25%.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See ya’ll next week!

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ILHEJSXBSFGCBFT3MSVKKP2ZXU.jpg)

:format(jpg)/www.coindesk.com/resizer/BETd9o0r2OHtd2vT2ZqY9QPrJps=/arc-photo-coindesk/arc2-prod/public/ODFQHDRZFJG7XNVO7P6PUYMWS4.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/XRKDRI5VLNAB5N74DL4DWKPSQQ.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KWIHT2IXGBGBZPP33VP6PJ4DDI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/BPZ5TEMBHFASTKCMWOM4CT33FY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/33ZHJXNCYRD3HLJNNA4CYPO5KI.jpg)