Bitcoin Drops to $27.5K While Dogecoin Spikes After Twitter Logo Change

BTC needs a catalyst to break the $30,000 threshold, says an analyst. DOGE spikes after Twitter changes its platform's logo to the dogecoin symbol from the blue bird.

Bitcoin (BTC) remained firmly within the range it has held for much of the past two weeks, trading as low as about $27,200 and as high as $28,400 Monday.

The largest cryptocurrency by market capitalization was recently trading at $27,500, down over 2% from 24 hours ago. BTC is up nearly 70% for the year after a buoyant first quarter in which investors grew more optimistic about inflation and other macroeconomic issues.

Yet, BTC’s price has been unable to ride above $29,000 for more than a few fleeting minutes in recent weeks as investors mull banking failures and fresh economic indicators that have been inconclusive.

“Bitcoin needs a bullish catalyst to break above the $30,000 level, but until some significant use case argument is made prices could consolidate around the mid-$20,000s,” Edward Moya, senior market analyst at foreign exchange market maker Oanda, wrote in an email.

Ether (ETH), the second-largest cryptocurrency, also slid 0.2% Monday to hover around $1,787. ETH’s price jumped 48% in the first quarter. Among other altcoins, the meme-based dogecoin (DOGE) – long supported by Twitter CEO Elon Musk – surged 16.5% after the social media platform changed its logo to the dogecoin symbol from the usual blue bird. Payments provider Alchemy Pay's native ACH token rose 7% after a Monday report that the company has received $10 million in investment from market maker DWF Labs at a $400 million valuation.

The CoinDesk Market Index, which measures overall crypto market performance, was up 0.1% for the day.

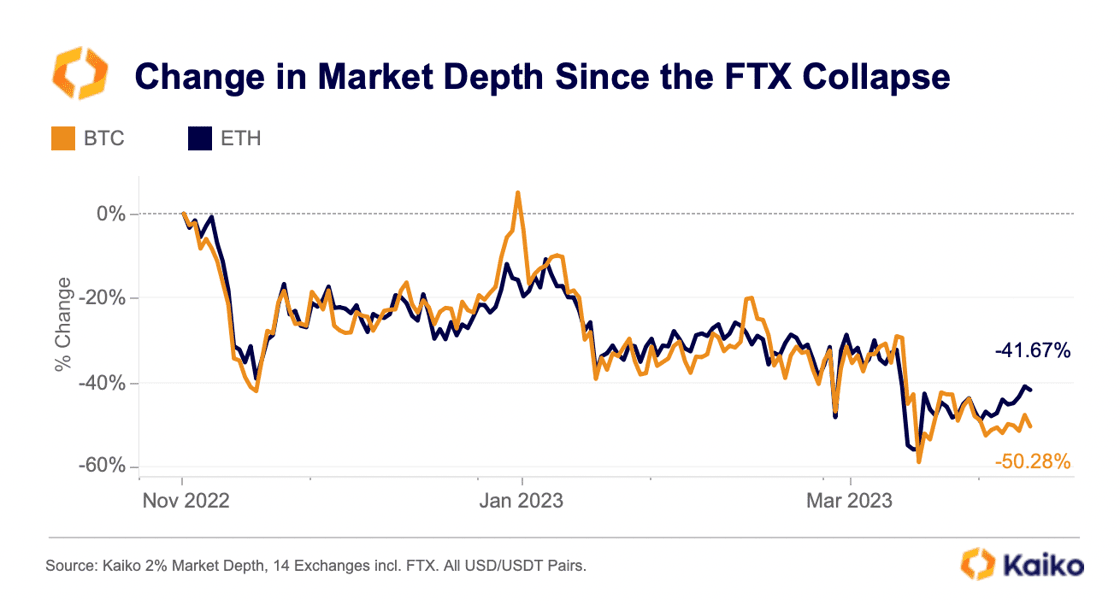

Meanwhile, market liquidity has continued to worsen. Crypto data firm Kaiko’s Monday report noted that both BTC and ETH’s 2% market depth, a metric for assessing liquidity conditions, has dropped by 50% and 41%, respectively, since the collapse of Alameda Research, the trading arm of crypto exchange FTX in November – a so-called “Alameda gap.” The ongoing decline has followed exchange Binance’s announcement that it was curbing its zero-fee trading program, Kaiko said.

(Kaiko)

“Both assets (bitcoin and ether) have suffered in the aftermath of the FTX collapse and banking crisis, with fewer market makers supplying liquidity to order books,” the report said.

Equity markets were mixed Monday. The S&P 500 closed up 0.3%, while the Dow Jones Industrial Average (DJIA) rose by 0.9%. However, the tech-heavy Nasdaq was down 0.2%.

Traditional market movements came after OPEC+ unexpectedly announced an oil production cut of over one million barrels a day, sending oil prices higher. Meanwhile, the manufacturing purchasing managers' index (PMI) on Monday showed that U.S. manufacturing activity in March dropped to its lowest level in nearly three years.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/XRKDRI5VLNAB5N74DL4DWKPSQQ.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KWIHT2IXGBGBZPP33VP6PJ4DDI.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/BPZ5TEMBHFASTKCMWOM4CT33FY.jpg)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/33ZHJXNCYRD3HLJNNA4CYPO5KI.jpg)